By NewsMediaWire - Bannor Michael Macgregor

•

06 Sep, 2023

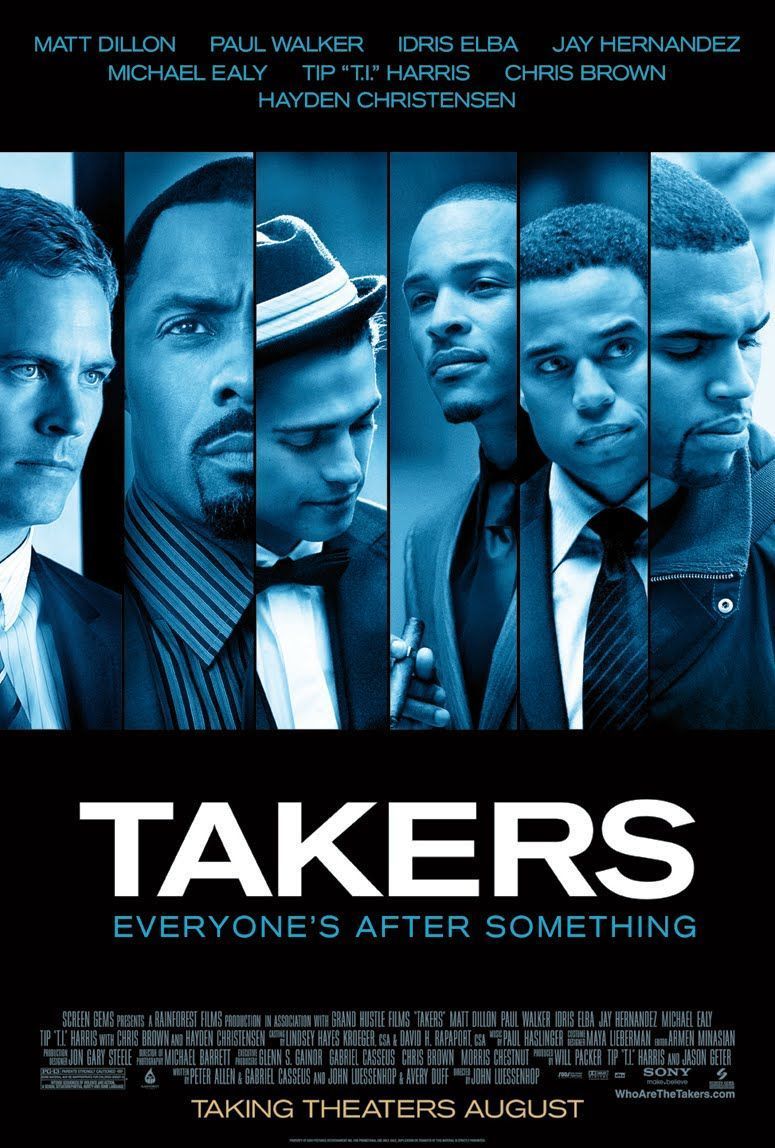

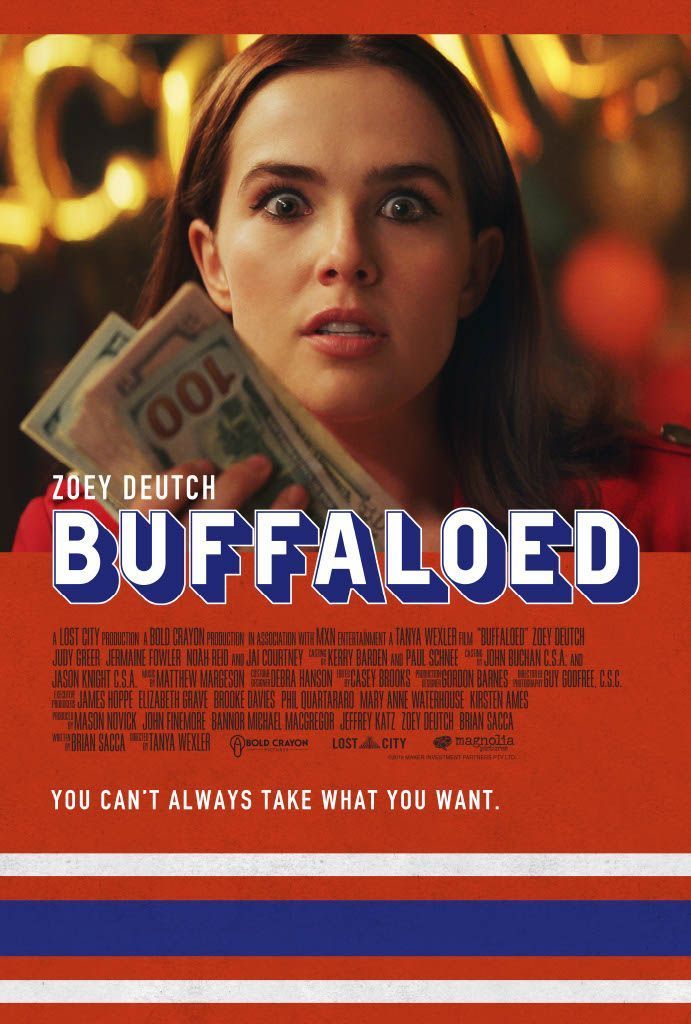

NEW YORK, NY, RALEIGH, NC, and LOS ANGELES, CA - (NewMediaWire) - September 6, 2023 - American Picture House Corporation (OTC: APHP), an entertainment company with a focus on producing feature films, limited series, and entertainment enhancing technologies, today provided a corporate update for shareholders. Industry Strikes - American Picture House supports the ideals behind the two current industry strikes -- brought by the Writers Guild of America (“WGA”) and the Screen Actors Guild (“SAG”) -- and joins the many reasonable voices urging for a fair and timely resolution. Update on Feature Films - American Picture House commenced preproduction on two feature films, ASK CHRISTINE and DEVIL’S HALF ACRE. Both productions are subject to interim agreements with SAG, with production for each project planned for late 2023 or early 2024. ASK CHRISTINE is a horror/thriller set in small-town USA. James Bruce (SURVIVOR, INDIVISIBLE: HEALING HATE) is in negotiations to direct based on a script by Danielle Silvie Gershberg. John Luessenhop (TAKERS, TEXAS CHAINSAW 3D) and Bannor Michael MacGregor (BUFFALOED) are producing. “DEVIL’S HALF ACRE” is an 1870’s period drama with maritime elements set in Coastal Maine, centered around the era’s most notorious poker game. Dashiell Luessenhop will be making his directorial debut based on a script he wrote. Filming is planned for Budapest, Hungary. American Picture House intends to announce a full slate of films later this year, including production of THE SECRET WAR, an historical-war drama based on CIA heroes in Laos during the Vietnam era, co-written by William J. Macdonald (ROME, THE SAINT) and John Luessenhop, to be directed by Luessenhop. Filming is planned for Thailand. About American Picture House Corp. American Picture House (OTC: APHP) is an entertainment company with a focus on producing feature films, limited series, and creating content-enhancing entertainment technologies. The Company partners with filmmakers, showrunners, content developers and strategic technology partners to develop, package, finance, and produce high-quality feature films and television shows with broad-market appeal. The Company plans to specialize in mid-budgeted productions. The Company’s management and advisors will use these assets to limit risk and guarantee greater profitability. The Company will strive to become synonymous with creative ability, financial sophistication, and leading-edge technology. The Company has optioned IP with the intent to co-finance and co-produce feature films and limited series. Forward-looking statements: Certain statements contained in this press release may constitute forward-looking statements. For example, forward-looking statements are used when discussing our expected entertainment content and intellectual properties. These forward-looking statements are based only on current expectations of management, and are subject to significant risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including the risks and uncertainties related to the progress, timing, cost, and results of producing entertainment content and product development programs; difficulties or delays in producing entertainment content or intellectual property protection. In addition, the following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: changes in technology and market requirements; delays or obstacles in launching our properties; inability to timely develop and introduce new content, products and applications; inability to retain or attract key employees whose knowledge is essential to the development of our products; unforeseen difficulties that may develop with our process; greater cost of final product than anticipated; loss of market share and pressure on pricing resulting from competition all of which could cause the actual results or performance to differ materially from those contemplated in such forward-looking statements. Except as otherwise required by law, American Picture House does not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. For a more detailed description of the risks and uncertainties affecting American Picture House Corp., please refer to its reports filed from time to time with the U.S. Securities and Exchange Commission. American Picture House Corporate Contact: Bannor Macgregor, CEO American Picture House Corporation www.americanpicturehouse.com macgregor@americanpicturehouse.com Tel #: 1-800-689-6885 NewMediaWire